GANN Hexagon Support & Resistance Calculator

"Elevate your trading skills with our Hexagon Support & Resistance Calculator"

Notice Board for Our Family ❤ & Loyal user ............👇👇 All Important Updates will be shown here

"Enter the Corresponding value of the input & make smarter trading decisions with our real-time calculator."

Enter Value :

Don't Know How to use this Calculator watch this tutorial👇👇

uploading soon!!!

GANN Hexagon Dynamic S/R Levels

60°

120°

1180°

240°

300°

360°

Support 1

Support 2

Support 3

Support 4

Support 5

Support 6

Resistance 1

Resistance 2

Resistance 3

Resistance 4

Resistance 5

Resistance 6

Our Hexagon S/R level calculator provides intraday Important levels for a variety of investment types, including stocks, options, futures, and commodities. Maximize your profits and make smarter trades with our powerful tool. Try it out today and take your trading to the next level!

Most Recent Video :

Blogs:

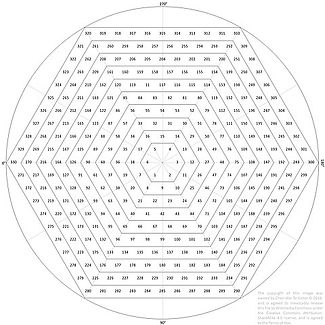

Introducing the Hexagon Chart:

A unique matrix of natural numbers that spirals out in the shape of a hexagon, starting from 0 at the center. Similar to the Spiral Chart, the Hexagon Chart represents consecutive numbers and follows a counterclockwise direction, inspired by astrological principles. Each layer of the chart symbolizes hexagonal numbers, which represent the number of distinct dots formed by the outlines of regular hexagons. Explore this fascinating chart to gain a deeper understanding of numerical relationships and patterns in a visually captivating way.

Unraveling the Mystery: The Fascinating History of the Hexagon Calculator

William Delbert Gann was a renowned trader and investor who made his mark in the early 1900s. Gann is widely recognized as a pioneer in the use of technical analysis in the financial markets. He is also known for his work on various charting techniques, including the hexagonal chart.

-

Gann believed that the hexagonal chart was a powerful tool for predicting market trends and movements.

-

According to his research, the hexagonal chart was based on the principles of geometry and mathematics, and it could be used to forecast market movements with a high degree of accuracy.

Gann's work on the hexagonal chart involved identifying certain key numbers and patterns that were present in market data. He believed that these numbers and patterns could be used to predict future price movements, and he developed a system for using them to make profitable trades.

Gann's work on the hexagonal chart has had a significant impact on the world of technical analysis, and his ideas and methods continue to be studied and applied by traders and investors today.

While some critics argue that Gann's methods are overly complex and difficult to understand, many traders and investors swear by them and have found great success using his techniques.

What is Support?

In technical analysis, support is a key concept that traders and investors use to determine potential buy or sell targets. Support is the price level at which there is strong demand for a security, which prevents it from declining further. It is the point on the chart where the majority of buyers step in and push the price back up.

When a security's price falls to a support level, it is often considered a good time to buy, as there is expected to be strong buying pressure. Traders can set stop loss orders just below the support level to protect themselves against a sharp drop in price. On the other hand, if the price falls below the support level, it could signal a bearish trend and potential selling opportunities.

One common tool used to identify support levels is the use of technical indicators, such as moving averages, trendlines, and Fibonacci retracements. These indicators help traders and investors identify potential support levels, and can be used in conjunction with other technical and fundamental analysis.

It is important to note that support levels are not always precise, and may vary depending on market conditions and investor sentiment. Traders and investors should also be aware of potential false breakouts or "fakeouts" where the price breaks through the support level, only to quickly bounce back up.

Overall, understanding support levels is an essential part of technical analysis for traders and investors, as it can help identify potential buying opportunities and manage risk in the market.

How a Support Calculator Can Help Your Stock Market Trading

Introduction:

Support and resistance levels are crucial indicators for traders in the stock market. They help determine potential buying and selling opportunities and provide insight into market trends. A support calculator is a tool that can be used to identify these levels and make informed trading decisions.

Understanding Support and Resistance Levels

Support and resistance levels are price levels where supply and demand meet, causing a price movement to reverse. Support levels indicate a price level where demand for a stock is strong enough to prevent the price from falling further, while resistance levels indicate a price level where supply is strong enough to prevent the price from rising further.

-

Mastering the Art of Trading with Support and Resistance

-

Are you ready to take your trading skills to the next level? Look no further than support and resistance, the ultimate weapons in your technical analysis arsenal. With support, you'll know when to buy low and ride the wave to the top. And with resistance, you'll be able to sell high and make a tidy profit.

-

But support and resistance are more than just numbers on a chart. They're powerful concepts that can help you unlock the true potential of the markets. By understanding these key levels, you'll be able to identify trends, predict price movements, and make smarter trades.

-

So how do you use support and resistance to your advantage? It's simple: think of support as a trampoline and resistance as a ceiling. When the price hits support, it bounces back up. And when it hits resistance, it falls back down. By studying these patterns, you can identify profitable entry and exit points for your trades.

-

But don't take our word for it. Many of the world's top traders rely on support and resistance to make their fortunes. So why not join them? With a little practice and patience, you too can master the art of trading with support and resistance. Read on to learn more about how to incorporate these powerful tools into your trading strategy.

How a Support Calculator Works

A support calculator is a technical analysis tool that calculates support and resistance levels based on historical price data. It uses various indicators and algorithms to determine these levels, making it a valuable tool for traders who want to make informed trading decisions.

Benefits of Using a Support Calculator

Using a support calculator can provide several benefits for stock market traders. It can help identify potential buying and selling opportunities, reduce risk exposure, and improve the accuracy of market trend analysis. Additionally, it can save traders time by automating the process of calculating support and resistance levels.

-

Enhanced accuracy: Calculating support and resistance levels manually can be a time-consuming and error-prone task, especially for novice traders. Support calculators use mathematical algorithms to accurately identify support and resistance levels, eliminating the potential for human error.

-

Time-saving: Support calculators can save traders a significant amount of time. Instead of spending hours manually calculating support and resistance levels, traders can input their data into the calculator and receive instant results.

-

Risk management: By using a support calculator, traders can better manage their risk exposure. They can identify key support levels and adjust their stop-loss orders accordingly. This can help minimize losses and protect profits.

-

Improved trading decisions: With the help of a support calculator, traders can make more informed trading decisions. They can analyze price movements and identify potential support levels to buy, as well as resistance levels to sell. This can lead to more profitable trades and better investment decisions.

-

Customization: Some support calculators allow traders to customize their calculations based on their trading preferences. For example, traders can adjust the time frame used in the calculations, or add additional technical indicators to improve the accuracy of the results.

In conclusion, using a support calculator can provide several benefits for stock market traders. By automating the process of calculating support and resistance levels, traders can save time and improve the accuracy of their analysis. Additionally, a support calculator can help manage risk exposure and lead to more profitable trades.

Tips for Using a Support Calculator

To make the most of a support calculator, traders should consider combining it with other technical analysis tools and using it in conjunction with fundamental analysis. They should also regularly monitor and adjust support and resistance levels as market conditions change.

Choosing the Right Support Calculator

There are many support calculators available for traders, each with different features and capabilities. Traders should consider factors such as ease of use, accuracy, and cost when choosing a support calculator that best fits their trading needs.

Conclusion:

In conclusion, a support calculator is a valuable tool for stock market traders looking to make informed trading decisions. By understanding support and resistance levels, using a support calculator, and combining it with other technical and fundamental analysis tools, traders can improve their accuracy in predicting market trends and making profitable trades.

-

The concept of support is a key element in technical analysis, which is widely used by traders and investors in the stock market. It refers to a specific price level where a stock's price has previously bottomed out and reversed its trend, bouncing back up from that level. This happens because at that price level, there is an increased demand for the stock, which prevents the price from falling further.

-

The support level is usually identified by drawing a horizontal line on the price chart, connecting the lows of the stock's price movements. Traders and investors believe that the price is likely to stop falling and reverse its trend when it reaches this support level. If the support level holds, traders might see this as an opportunity to buy the stock at a discounted price, expecting it to rise from that level again.

-

The concept of support is not limited to individual stocks but can also be applied to entire markets or indices. For example, a support level for the S&P 500 index might be identified by connecting the lows of its price movements over a certain period. Similarly, a support level for a sector index such as the technology sector might be identified by connecting the lows of the sector's price movements.

-

It is important to note that a support level does not always hold, and the price can break through it, indicating a trend reversal. Traders should also consider other technical indicators and fundamental factors before making trading decisions based on support levels alone.

-

In summary, the concept of support is a crucial aspect of technical analysis that helps traders identify potential buying opportunities and reduce risk exposure. By identifying and analyzing support levels, traders can make informed decisions on when to enter and exit trades, as well as manage their portfolio's risk effectively.

.png)